The forex market offers many opportunities that can be taken to make profits in forex trading. But to be successful, you have to know beforehand advantages and weaknesses. Most forex tutorial teaching only “The right way for trading”. And this is not entirely true. As an adult, you will be hard to change your style of trading, while the market is changing all the time. Therefore, it is much easier to find a trading technique that fits your personality rather than trying to adjust to the way trading other people who may be “expert trader”. Forex tutorial article will discuss how to find your style of trading.

Trading strategy

So why fishing and skiing downhill so important? Believe it or not, this is the question of trends and counter trends in trading. Anglers are the trend, skier likened contrarian trend. Trader trends, they are like anglers bait several times before finally getting the fish. On the other hand, downhill skiers, seeking the sensation of speed before he reached the end goal. If the note is similar to profit as soon as possible because the currency price movements are fast. Does fishing always lead to trends and ski bucking the trend? Of course not. However, the activity you choose certainly reflect your trading style.

Time Frame

The second most important question is whether you are more comfortable using the time frame for the short-term or long-term? Generally, traders who trade based on the trend would choose a longer time frame for developing trends in forex trading by months rather than days. While that prefers to use a fast changing market sentiment will operate on a shorter time frame.

Typically, the short time frame that is effectively used is the hourly chart with a target average profit / risk of at least 30 points, due to the nature of the market that spreads led to a smaller time frame less effective. For example, the pair EUR / USD, which is the most liquid instrument in the world and usually widespread bid and ask ya 3 points. A trader with a profit target of 10 points should get 13 points profit (10 points + 3 points spread), but sometimes he just gets 7 points only (10 points – 3-point spread). This is what causes many traders think negatively because of the difficulty of finding profits in short time frames.

Analysis Type

Once you determine the best time frames, the next question is: what kind of analysis you will use to trade forex? There are currently a lot of debate between fundamentalists and technically

Fundamentalists mock technical attempts to forecast future price movements by looking at the current price movement on the chart. Proponents of fundamental analysis technical analysis consider such ancient rituals forecast the future of the stomach contents of dead animals. News, economic reports and comments from monetary officials is the main tool fundamentalists. Technically ignore the data as something sad and contradictory, they believe the market response in addressing the news will be reflected in the price movement before and will be a guide to future price movements.

Which one will be the winner? None. Trading in terms of technical or fundamental only as figments, like boxing in the race for the world title with one hand tied behind my back. Fundamentalists can talk, due to the global demand for oil will push crude prices to $ 100 / bbl and they buy the Canadian dollar as the greenback, but when seen in near-term chart of USD / CAD looks oversold, then it is likely they will lose money

– even when a few moments later turned out they were right analysis. Conversely, technically use Fibonacci numbers to determine benchmark prices suddenly no economic news makes the market turmoil, the level of resistance that has been made will be torn down as traders tried to cover their positions.

Fundamental to Long term, Technical for short term

You need to remember, that the fundamental factors tend to have a strong impact on long-term trade, while the technical aspects will be a strong impact on short-term trading. For the long term will usually respond to economic news as GDP growth, interest rates, and other economic factors.

For example, we see the movement of GBP / USD in 2005 in the image above. At that time the Federal Reserve Bank of New York was raising interest rates by 200 basis points from 2.25% to 4.25%, while the Bank of England, which was at that time the UK is experiencing a slowing economy and depressed consumer sentiment, choose lower interest rates from 4.75% to 4.5%. The difference in interest between the two currencies converted to almost 0% (at the beginning of 2006, has reached 0%). Traders who trade long term and short term are equally benefited for GBP / USD decline.

This pattern is similar to the movement of the USD / JPY but reversed. USD moving while the Japanese Yen remained 0%, this has led to traders taking positions with the hope of profit 20% in a matter of months. In 2006, analysts predict that the US tightening cycle coming to an end while Japan is just starting, traders responded immediately so that they can benefit substantial and analysis that they made proved to be correct.

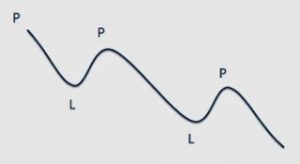

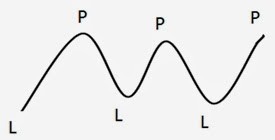

From the above events, we can see that the fundamental factors have an effect in the long term, while technical analysis reacts within a shorter period of time. Perhaps one of the reasons why this happens is that the smaller time frame news information was not considered significant, therefore, prices tend to move to areas of support and resistance. For example, as shown in the picture hourly chart EUR / USD below, note the area swing high and swing low of, traders can install Sell position when prices were resistance and Buy at support area to benefit.

NOTE: This article Forex Tutorial:

Whether you are a long term trader or technical fundamentalist short term, the forex market can all accommodate your style. Despite the disagreement between the two is never resolved, but the undeniable truth is that you have to use a style that best suits your personality. If not, you are not likely to succeed. Therefore, the first question for the novice forex trader is not “What if the price going up or down?” But “Trader whether I have”.