Risk Management

Risk affiliated factor of any business. True, there is no business that free from risk. Risks can not be deleted, but can be “controlled”.

The risks faced every form of business is a loss. Similarly in the futures trading business like this. Futures trading is a form of business that potentially high risk. However, chances of profit (return) offered no less high.

Well, in order to maximize the chances of looses it (as well as minimize the risk) risk management is needed, or what is known as the “risk management”.

By applying risk management, meaning we implement full control over our money. We can limit the extent of losses that might be we experienced. Like a game of chess, we must prepare what steps we will run and anticipation if we step it wrong.

Remember that no single person could determine the future. Thus, also nobody knows exactly where price will move. Most novice traders fail because they do not have a good risk management basis.

Risk Management Tools

In forex trading, the application of risk management is assisted by four engineering risk management: cut loss, switching, averaging and hedging / locking.

1. Cut loss

Cut loss immediately ends the transaction carried out with the losers in order to avoid the potential for greater risks.

For example, we predict the price will go down, and we do Sell 1 lot at 1.50200 level. It turned out that in fact the price moves up to the level of 1.50500, so we suffered a loss of -300 pips. Because we do not want to face the risk of greater losses, then at the level of 1.50500 Sell position before we close, with the consequences we suffered a loss of -300 pips.

2. Switching

The goal is to get rid of a loss position so as not greater then his cover by opening a new transaction as opposed to the initial transaction. Usually done for the conditions when the price movement is relatively tight.

For example, we open a Sell position at 1.50200, and even the price moves up. Arriving at the 1.50500 level, the position we’ve suffered a loss of -300 pips. If we assume that the price movement is still going up, then at the 1.50500 level we close our SELL position earlier. At the same time, we also opened a Buy position at 1.50500 level.

If it turns out the price actually increased up to the level of 1.50800, then the Buy position we were going to get a profit of +300 pips. That is, losses -300 pips due to Sell positions had been covered.

New switching should we do when we really believe that prices will continue the direction of movement. Therefore, by switching means we open a new position that would have the potential loss as well, if the prices reversed direction again. Here the required maturity level analysis and mental readiness for a trader.

3. Averaging

Averaging (or ‘cost-averaging’) is a form of risk management that is quite extreme, because basically these techniques “against” the direction of price movement. This technique can only be used for traders who have a mental “steel” and also must have substantial funds.

Suppose we do Sell 1 lot at 1.50000 level. When the price moves up to the level of 1.50500, we are not closing position earlier loss, but we add another one position Sell 1 lot. At this level, our losses have reached -500 pips.

Apparently, the price rose again to the level of 1.51000. At this level, we’ve become a total loss -1500 pips. Our loss will be covered if the price falls again to the level of 1.50500. If at this level we closed all our sell position, then our losses will be zero.

If the price falls again to the level of 1.50000, then we will get a profit of +1500 pips.

This technique is good only if we use the sideway market situation, because the opportunities for price back to our starting position is greater.

4. Hedging

There was also a call “locking”. Actually, this technique is a technique which is strange, because the trader who suffered actual losses can not do anything against the losses that have been suffered.

You should not do this. The only reason this technique described here is to let you know that there are some traders who use this technique.

When a trader sell 1 lot at 1.50000 level, he will experience a loss of -500 pips if the price rises to the level of 1.50500. (Remember yes, he has a loss, guys!)

But he did not want to “throw” the loss on an existing position. He just made a Buy 1 Lot at the price of 1.50500. Well, at this moment the trader “lock in” the loss of -500 pips. That is, wherever the price moves later, suffered losses only amounted to “lock” it.

Whatever it is, clear the trader already suffered losses. It’s no different to cut losses, it’s just that there are no closed position.

When the price rises to 1.51000, the trader closes a Buy position accomplishments in the price of 1.50500 earlier. Although this benefit a Buy position +500 pips, but do not forget SELL position remains on the bottom (the current losses of -1000 pips!). Therefore, our traders are still suffering a loss of -500 pips.

The trader losses will be covered if the price moves down to the level of 1.50500, if at this price he closes Sell position for the first time did (at the price of 1.50000). +500 Pips profit will be obtained if prices fall to the level of 1.50000.

This is the “justification” is often used as an excuse for the perpetrators locking. And to be examined again, the above incident is no different than to cut losses at the price of 1.50500, then SELL again at the price of 1.51000. Try any reckoning!

In determining the level of entry (buy or sell) and cut loss level, switching, and so on, we can combine them with technical analysis as we know.

Strategic Capital Management (Money Management)

Averaging technique has several developments that can be tailored to the resilience of capital that we have, so it is often also referred to as “capital management”.

Some developing averaging technique is pyramiding, martingale and anti-martingale.

• Pyramiding

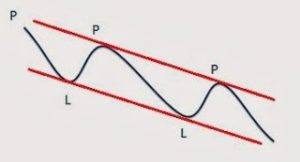

Pyramidingis the opposite of cost-averaging. If the cost averaging we add an open position whenever a loss, then the pyramiding we add to the open position each time benefit.

In the picture shown, every time we get a profit of 500 pips, then we add again buy 1 lot. When the price dropped from 1.51000 to 1.50750, we still left a total profit of 750 pips. At this level we have met all of our buy position. If the price falls to the level of 1.50500, then the entire transaction we will break even.

This technique is good if we use the time in a state trending prices.

• Martingale

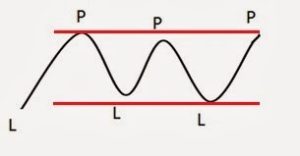

Martingale is similar to the cost-averaging. But the martingale, we add to the open position doubled from the previous position each time losses.

In this example it was shown that the trader to add short positions as much as twice the previous position every increase of 500 pips. Should prices still rose to 1.51500, then the trader will add as many as 8 Lot Sell position.

In this example, it was shown that the benefits gained when prices return to 1.50500.

To watch is if prices continue to rise, then the losses will be even greater.

This technique is worthy when market conditions sideway.

• Anti-martingale

Anti-martingale precisely similar to pyramiding, and is the opposite of the martingale, which we add to the open position doubled from the previous position each time benefit.

We should continue to pay attention to price movements, not to make a profit that reversed the direction we’ve collected instead turned into a loss.