Basically, trendline and channel also are support and resistance. At the time of down trend, trendline serves as resistance. Conversely, when the uptrend, serves as a support trendline.

Basically, there are two strategies that we can apply based on support and resistance. The first is called “bounce trading”, the second is called “trading breakout”.

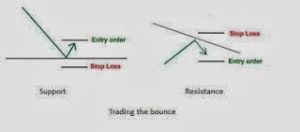

Bounce trading

There was also a call as “swing trading”. This trading method utilizes a “reflection” price when the price has reached a support or resistance and bounced from there.

This illustration will explain what is meant by this trading bounce.

Essentially you wait for no reflection on the area of support or resistance for trading. Why not conduct a proper sell at resistance or buy right on support? Because you need some kind of confirmation that the support or resistance is not translucent. It could be the price movement up or down so sharply and quickly to the right through the support or resistance. Well, sort of reflection that is the sign that the level of support or resistance is still strong.

Breakout trading

In the world of trading, the support and resistance will not last forever. At one time these levels will definitely be translucent. At such times you can still try to find opportunities with a strategy called breakout trading. Breakout trading strategy is one hundred percent different from a trading bounce. If the trading bounce you wait to buy or sell, on a breakout strategy you instead utilize support and resistance break with the assumption that the break of support or resistance tends to be followed by a rally.

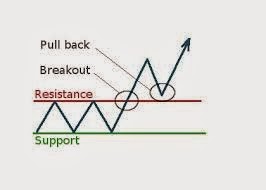

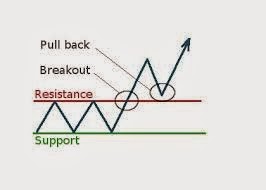

The illustration below depicts breakout trading strategy by utilizing the break of support or resistance.

The strategy described above is an aggressive strategy, in which the transactions are performed immediately after getting confirmation break of support or resistance level. Yep, once again the confirmation needed to take action.

A support or resistance is considered transparent if it meets at least one of the following two things:

- If you are using a candlestick chart, then the body of the candlestick should be cut / pierce support or resistance line.

- At the time of the breakout, an increase in volume. The more significant improvement, then it is considered more valid breakout.

It had been a breakout trading strategy that is aggressive. But there are traders who choose to wait for further confirmation. Confirmation confirmation again … again … maybe that’s what you are thinking now. Get used to it, because you will repeats these words throughout your trip jungle go through this challenging trading.

Class of traders who do not aggressively implemented a breakout strategy is rather conservative. To be easier, we call it conservative breakout strategy. How does this conservative strategy?

This conservative strategy actually merges breakout and bounce trading strategy. Here’s the story. …

When the breakout has been confirmed, you do not immediately take a position to buy or sell a breakout strategy as aggressive, but you wait occurs “pullback” back to the area of support or resistance. After the pullback, you wait longer occurs reflection of the level of support or resistance. Only then you perform a transaction to buy or sell.

Complicated huh? Actually, not really. Make it easier to understand, we have prepared an illustration to describe this strategy.

Good strategy breakout aggressive or conservative has its own advantages and disadvantages. If you use a breakout strategy is aggressive, your benefits are immediate entry and you can not miss “moments”. But of course, this strategy has its drawbacks. Suppose that you have a sell immediately when support breaks, but in fact, prices rose again and was back into the support earlier.

Conservative strategy has the advantage in that regard. By using this strategy, you’re likely to get caught is smaller as you wait for a pullback ahead and seek confirmation of reflection. But keep in mind also that the pullback NOT ALWAYS HAPPEN after the breakout. This is where the weakness of the conservative strategy, ie you will potentially lose the opportunity to entry because it was already running.

Every trader has a different style. You can decide whether you are going to be the aggressive or the Conservatives. For the patient, a conservative strategy might be appropriate for you to apply. However if you are a private agile and like the challenge, may be more appropriate to use an aggressive strategy. Please select according to your personality.