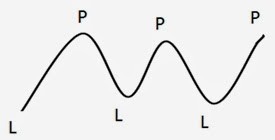

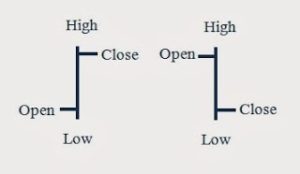

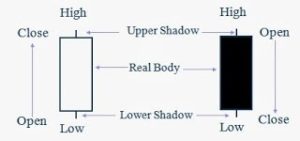

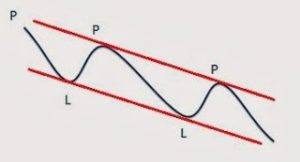

Channel is one of the tools of technical analysis which is the development of the trendline. How to draw quite simple, we just duplicate the trendline that we have made. The steps, the first time we are drawing the first trendline in accordance with the direction of the trend. In the image below, for example, we draw a trendline on the current uptrend.

Then, we draw a line parallel to the trendline. This second line then we project that connects the dots peak. Similarly, the trendline, this line must be at least connecting the two peaks. Be a UP CHANNEL or also commonly referred to as ASCENDING CHANNEL. Simple right?

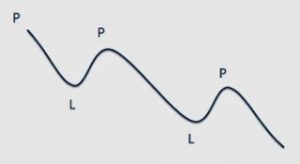

As for drawing a CHANNEL DOWN; or often referred to as DESCENDING CHANNEL; as simple as drawing a bullish channel. First, the first image trendline that connects at least two peaks. Then create a line parallel to the trendline connecting at least two valleys. Below is an example of down channel.

Although, this channel is very useful. These channels can later be utilized to estimate the area of buy or sell. The second line of the channel serves as support and resistance. The line that above serves as resistance, while the line below serves as a support. To make it easy we call it the two lines as lines of support and resistance lines.

When prices are in the area support line, then we can try to look for confirmation in the form of a bullish signal to buy, with a target at the resistance line. Beware if the price breaks below the support line. If it happens, it’s good to consider removing such transactions. Of course, this will also have to see the development of the market situation. This issue will be discussed later, in the topic further.

Similarly, when prices are in the area resistance line. At that time we could try to look for bearish confirmation signal to sell with a target at the support line. Of course, we should be wary if the resistance line breaks after we do sell.

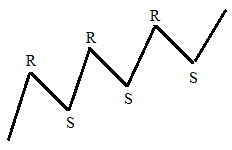

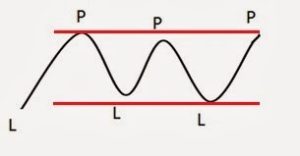

Sideways Channel

There are times when prices move sideways, so we can not draw up the channel or channel down well. In these circumstances, we can draw a horizontal channel. We call this channel such as a channel or ranging sideways channel.

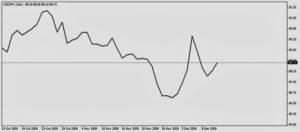

Below is an example of a graph that presents three types of channels that we have discussed, the channel up, channel down and sideways channel.