There are three things that underline technical analysis. The basic three are

1. Market action Discounts everything

One of the advantages in using technical analysis is that the movement of price (price action) is likely to reflect the information circulating on the market. Is it a rumor or sentiments. Thus, the things we need to take decisions is price movement itself. So we do not need to be troubled by news or rumors, for example, regarding John Doe want to do this or that. Just look for the price action of his. We will discuss it more depth about this

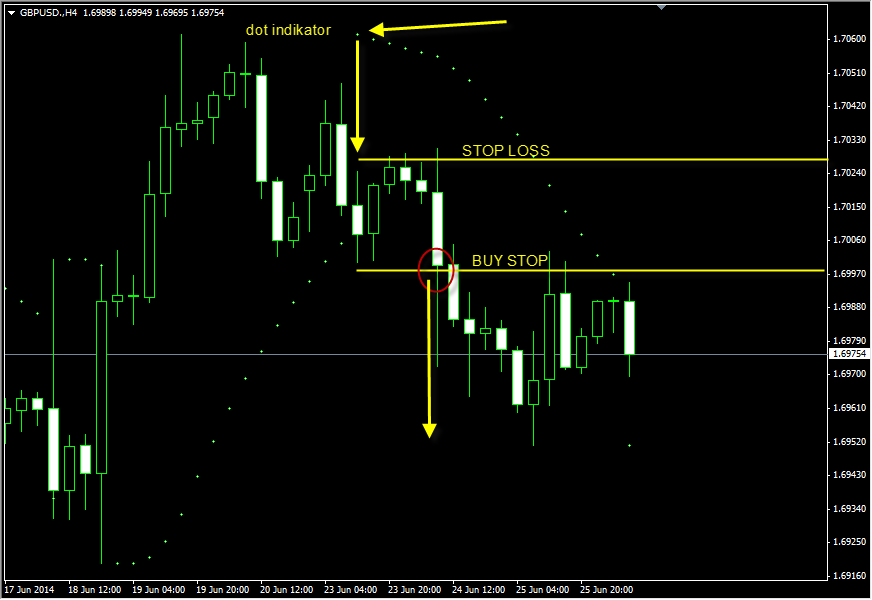

2. Prices move in trends

Prices move in trends, he said. So, not only are there fashion trends. The price movement has also, you know! The point is that the price movement tends to move in the direction (trend) until a certain moment the trend will end. Its direction can be raised, lowered, or flat course. By knowing the market trends, then we will be able to take the right decision.

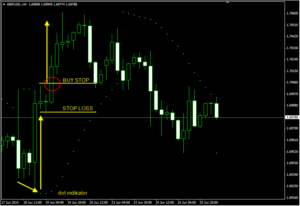

3. History repeats itself

History always repeats itself. The technician (the term for trader “prow” of technical analysis) found that price movements tend to form certain patterns. These patterns also have a tendency to recur from time to time. Thus, the recurrence of these patterns can be used to predict which direction the next price movement based on the “history” is recorded when the same patterns emerge in the past.

Technical analysis can be very subjective. Two analysts who look at the same chart might have a different view. This can happen because both have different styles. This subjectivity those that can be anticipated with a solid base of technical analysis. The important thing now is that you understand the basic principles of technical analysis before, so it will be easier to understand the more complex technical analysis such as technical analysis based on Fibonacci theory or John Bollinger