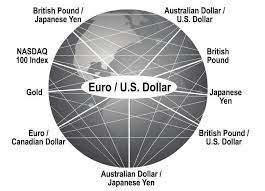

You will get a much clearer picture if we could understand how markets interact with each other. It would be very interesting to observe the relationship between the commodity, the price of bonds, stocks, and currencies.

In most cycles, there was a general order in which the four markets may move. By looking at all of the movement, we will be better able to judge which way the market will move? Because in principle the four markets cooperate and some against direction.

Push and Pull

Let’s see how the prices of commodities, bonds, stocks, and currencies interact. When commodity prices rise, the cost of goods will be pushed up thus increasing the price movements or inflation. In turn potentially, interest rates will also increase.

The relationship between interest rates and bond prices are inversely proportional. Therefore usually bond prices will fall when interest rates rise.

In general, bond prices and stock prices are correlated. When bond prices begin to fall, then the stock price will eventually follow suit due to the cost of borrowing becomes more expensive and the cost of doing business rose due to inflation.

Again, we will see moments between bond prices fall which caused a decline in the market price of the stock.

Currency markets have an impact on all markets, but the main focus on commodity prices. Commodity prices will affect the price of the bond and then stock prices.

The US dollar and commodity prices were generally in the opposite trend as the dollar declined against other currencies.

Application

Intermarket analysis is not a method that can provide a signal to buy or sell signal. However, providing excellent information to confirm trends and will provide information on the potential reversal in price direction.

If commodity prices rise, bond prices have started to turn lower. A matter of time to wait for the stock price falls.

Nonetheless, this is only a kind of “warning” that there will be a reversal of the trend that will probably happen in the near future if bond prices continue and change to a lower level.

Inter market Analysis Not Succeed?

There is always a correlation between these markets, but there are times when correlations mentioned above will not give a good picture.

When the collapse of the Asian market in 1997, the US market saw share prices and bond prices goodbye (stocks fall as bond prices rise, and stocks rose as bonds fell). This violates the positive correlation of bond and stock prices. So, why is this happening?

A typical market relationships will look when inflation looks. So, when we moved into a deflationary environment, the relationship will shift.

Deflation generally will push the stock market to move to a low level without any potential for stock price growth. On the other hand, bond prices will move higher to reflect the decline in interest rates (remember, interest rates and bond prices move in opposite directions).