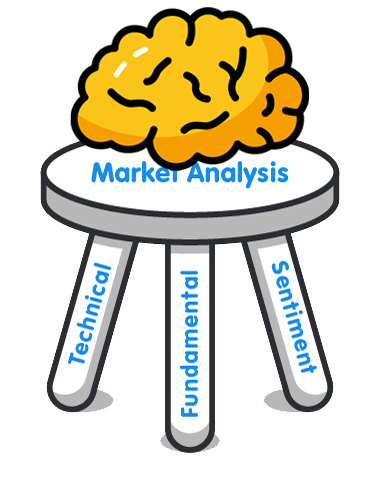

1. Fundamentals

Forex fundamentals are largely centered around currency interest rates. This is due to the fact that interest rates have a considerable effect on the forex market. Other fundamental factors include such as gross domestic product, inflation, manufacturing, economic growth activity. However, whether other fundamental releases are good or bad is less important than how they affect the country’s interest rate.

Traders reviewing fundamental releases should keep in mind how they may affect future interest rate movements. When an investor is in risk-seeking mode, money follows yield (currencies offering higher interest rates), and higher rates can mean more investment. When investors are in a risk-adverse mentality, money leaves the yield for safe-haven currencies.

2 . Technical

Forex technical analysis involves looking at patterns in price history to determine higher probability times and places to enter a trade and exit a trade. Consequently, technical analysis in forex is one of the most widely used types of analysis.

Because FX is one of the largest and most liquid markets, moves on the charts from price action generally provide clues to hidden supply and demand levels. Other patterned behavior such as which currency is trending the strongest can be gleaned by reviewing price charts.

Other technical studies can be carried out through the use of indicators. Many traders prefer to use indicators because the signals are easy to read, and it makes forex trading simpler.

Technical versus fundamental analysis in forex is a widely debated topic. There is no one right answer to the question which type of analysis is better and traders tend to adopt one, or a combination of both, in their analysis.

3. Sentiments

Forex sentiment is another very popular form of analysis. When you see sentiment heavily positioned in one direction, it means most traders are already committed to that position.

More astute traders will analyze retail sentiment as well as sentiment at the institutional level. Senior Analyst Tyler Yell explains how traders can analyze Commitment of Traders (CoT) reports for clues about how the institutional market is positioned and how to apply this analysis to their trading analysis.