Succeeding in foreign exchange transactions, and the resulting financial independence can offer many advantages.

“I pay cash”

Learning Forex who do not want to pay large cash purchases. For a successful trader is no problem and has many advantages. Interest to be paid on these loans can be stored and used for transactions in the foreign exchange market. This is one reason why the rich get richer is because you do not have to have debt. Who does not have debt, do not have to worry about monthly payments and make it more focused on things that are more important, as the Trader

example.

Find a profitable transaction and apply the rules of transactions in the Forex market is profitable.

There is also a trader who acquired the trading capital of a large debt and objectives initially to repay debts with interest. However, anyone who can pay for a car or a house in cash, will have a better idea in trading.

Trading book “Pit Bull: Lessons from Wall Street Champion Day Trader” by Marty Schwartz talks about how he bought the beach house in the Hamptons for $ 400,000 and paid in cash. In addition, he also wrote in the 1980s, an apartment costing $ 3,000,000 paid in cash, all paid for with profits in trading on financial markets.

This can only be done by a successful trader. They bought a house in cash and without batting an eye.

Access to get the best price on the market

If a successful trader decides to buy a house or something more expensive, he will get a much cheaper price than the average of other consumers. This is because the mortgage you get better deals from banks and thus get a higher credit limit. This is not only true for any successful trader, Facebook boss Mark Zuckerberg, for example can finance his home with only 1% interest rate.

Buying in bulk

To get a better price, rich people buy goods in bulk. The price difference is stored so that it can be used to finance a hobby or to increase the capital of the trading account.

Travel and relocation without problems

As a wealthy trader, namely having a financial background is not a problem, sometimes the mood quickly changed if only in the house. When the psychological condition is not in accordance with the housing situation or the environment in which he lived today, he can buy a house in another city or even another country who could make it comfortable. Foreign exchange and stock markets can be traded from anywhere in the world. To ensure smooth access to the trading platform only needs a stable internet connection.

Freedom while

This is an important point. Money can buy many things, including freedom. At some point, almost every wealthy trader said: “I want to find out what is needed in life”

Because money can not buy everything.

In fact, money is not everything in life. Just as Gordon Gekko in the movie Wall Street 2 says:

One thing I learned in jail is that money is not the highest good in one’s life. The most important thing in life is the time you have and how to use them.

You often hear about how the rich get richer. Especially in the financial crisis of the last few years, often discussed in the media. But why is that?

Gather assets can be a way that is simple and secure for example Shares from bank. In general, no matter what the financial reserves invested, both in the stock market or other long-term investments, each year will get quite a lot of interest.

Of course here the amount of capital plays an important role. Simple and interesting way to get a few million as pocket money stored on your daily account.

Through its network rich people get access to investment opportunities and attractive business. More and more investment opportunities you have, the higher the likelihood that generate very high profits.

So, if you ever once making money, to produce again and again not too difficult. There’s a saying:

The most difficult is the first millions.

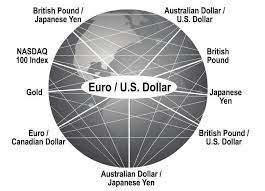

Currently more easily become rich quickly by trading in financial markets rather than the past. Access to all the necessary information more accessible than ever before. Such as books, articles, videos and more. All things are not owned by trader 30 years ago. Today in a matter of seconds you can make forex demo account, charts are readily available and can be open – closed the transaction in real time via the Internet.

Perhaps the biggest hurdle to traders is how to perceive and interpret the information available with the right to take the best decision.

What should I do to become a successful trader?

Perhaps you have doubts whether you can arrange for continued success in forex trading for the long term.

Doubts like this is useless. Concerns loss of savings can be overcome by habit to always work hard.

I have long been looking for the perfect trading system. I have spent a lot of time in finding a trading system that has a high degree of victory. Technical indicators, Forex Robot, chart patterns and price movements. Everything does not give any real success.

I would have given up. I try to rest for a few weeks and months, but I never really give up or lose confidence to obtain success. With strong determination to succeed and through further research, I became aware of the things that affect and cause market movement. Not an indicator, chart or Forex Robot but market participants and their expectations in the capital market as you invest.