Are you looking to dive into the world of foreign exchange trading? If so, you’re in the right place.

Forex strategies are an essential part of successful foreign exchange trading. With these strategies, you can make informed decisions about when to buy and sell currencies, as well as plan for long-term investments. This can help you maximize profits while minimizing risk.

In this article, we’ll explore different forex strategies, including fundamental analysis, technical analysis and swing trading. We’ll also discuss strategies such as risk management and portfolio optimization. By the end of this article, you’ll have a better understanding of forex strategies and how they can be used to maximize your trading profits.

What Is Forex?

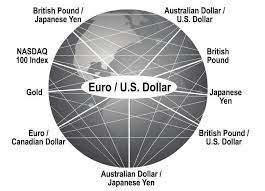

Forex, also known as foreign exchange or FX, is the trading of one currency for another. It is one of the most popular global markets where participants from all over the world can trade currencies. It involves buying and selling currency pairs in the hopes of making a profit from the exchange rate. The most actively traded currency pairs are USD/EUR, GBP/USD, USD/JPY, and USD/CHF.

Unlike stocks or commodities, Forex traders are not limited to trading one currency for another. They can also use tools such as spreads, contracts for difference (CFDs), and forex options to gain exposure to a larger range of global markets. In addition, Forex traders can take advantage of leverage to increase their potential returns from trades. This means that with a small capital investment they can control larger positions than they could with regular trading accounts.

Forex is an exciting way to speculate on global markets and create additional income sources. With its 24-hour availability and low transaction costs, it provides an efficient way to diversify your portfolio without having to pay large commissions.

Benefits of Investing in Forex

Forex trading can be profitable, but it is not a get-rich-quick scheme. It is important to understand the risks associated with Forex trading before investing any money. When done correctly, Forex trading has the potential to provide a steady stream of income.

There are a few key benefits to investing in Forex:

Leverage: The use of leverage can significantly maximize your profits, as you’ll only need to put up a small amount of capital (called margin) for each trade you make.

Liquidity: The large size and depth of the Forex market ensures that you can enter or exit any position quickly and easily, minimizing slippage.

Low Commission Cost: Most online brokers charge very low commissions on trades, allowing traders to realize more profit from successful trades.

24/Hour Market: The Forex market is open 24 hours a day, 5 days a week meaning you can take advantage of price movements at any time.

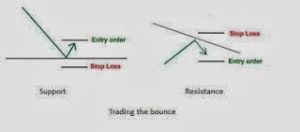

Limit Price Risk: By placing stop losses, traders can limit their risk level on each trade they make.

By being aware of these benefits and being mindful of the risks involved in Forex trading, investors have the opportunity to realize greater profits while also managing their risk exposure.

Different Types of Forex Trading Strategies

When it comes to forex trading, there are several strategies which investors can use, depending on their level of expertise, risk appetite and investment goals.

Fundamental Analysis

Fundamental analysis is a popular approach to forex trading which involves studying news events and economic data such as inflation numbers and interest rates in order to determine the direction of a currency pair over time. Fundamental analysis is especially useful for long-term investments as it helps traders gain an understanding of how external factors could affect the value of a currency over the course of weeks, months or even years.

Technical Analysis

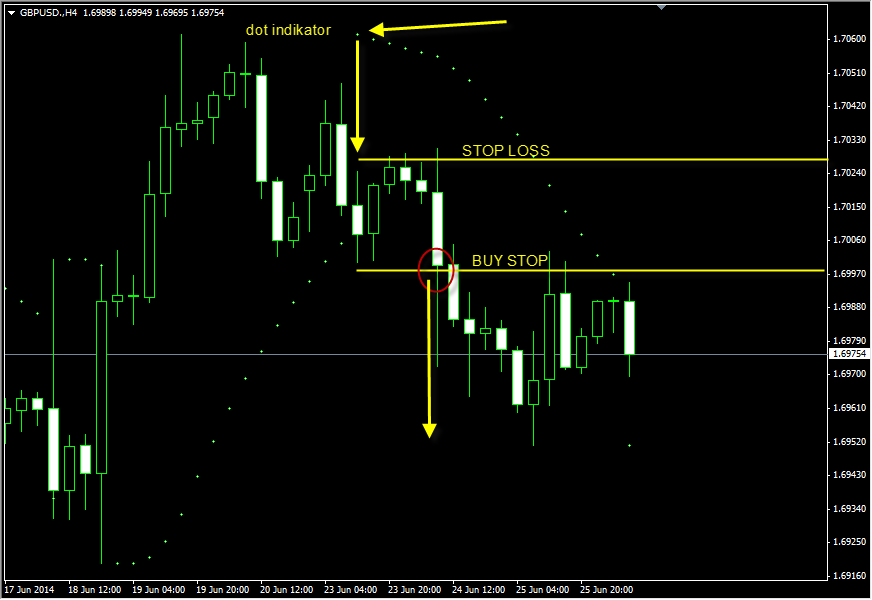

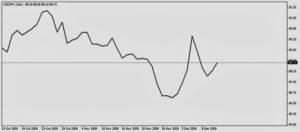

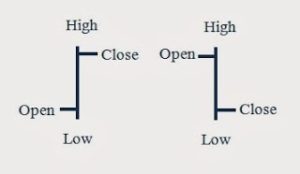

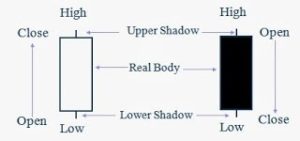

Technical analysis is another type of forex trading which involves analyzing the movement of price action to predict future market activity. This type of analysis focuses on chart patterns and indicator signals such as MACD and RSI. Technical analysis is often used by short-term traders who are looking for quick profits by taking advantage of small price movements in the market.

Scalping

Scalping is a type of forex trading strategy that attempts to make multiple small profits from short-term market movements. Traders who use this strategy will enter and exit positions very quickly, usually within minutes or seconds, in order to profit from even the slightest increase or decrease in a currency’s price. This type of strategy requires traders to remain very active in the markets, often making multiple trades within a single hour.

Technical Analysis for Forex Trading

Technical analysis is an important strategy for forex trading, as it looks at patterns in the market to identify future trends. It involves analyzing all the data available about a particular currency pair and its history of movements, to determine how the price will change.

The key principles of technical analysis are:

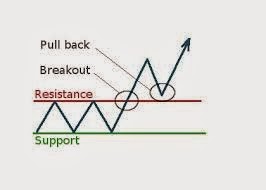

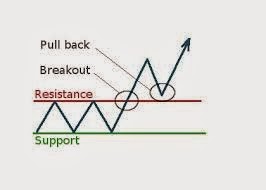

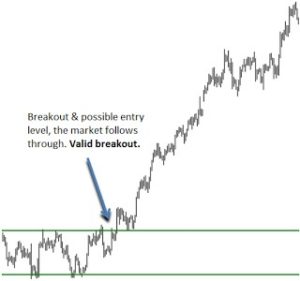

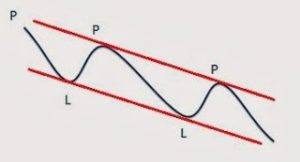

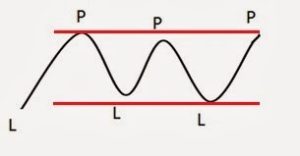

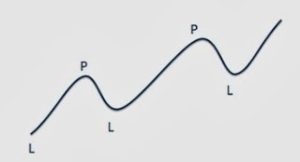

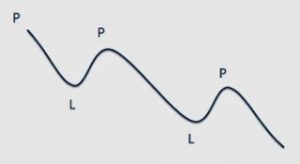

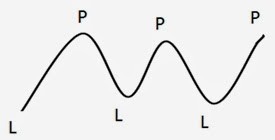

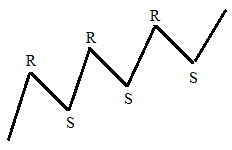

Identifying support and resistance levels – This refers to the areas where prices tend to stop rising or falling in a trend.

Analyzing chart patterns – This involves looking for repeating patterns in price movements that can signal possible changes in direction.

Keeping an eye on indicators – Technical analysts use various indicators such as moving averages or stochastics, to show possible areas of support and resistance, momentum and overbought/oversold conditions.

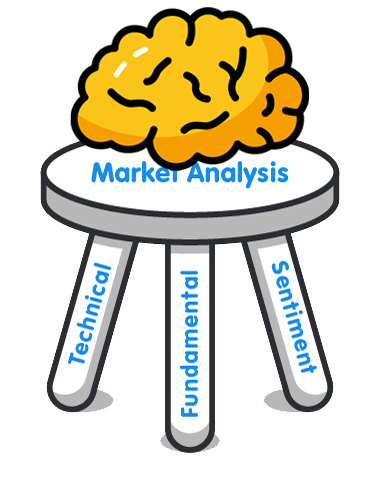

Technical analysis is most effective when used in conjunction with other strategies such as fundamental analysis, which looks at the overall economic picture and influences on currency values, or sentiment analysis, which looks at investor sentiment towards certain currency pairs. By combining these strategies, traders can gain valuable insights into future market movements and make informed decisions on when to open and close positions.

Fundamental Analysis for Forex Trading

The fundamental analysis approach to Forex trading is one of the primary strategies within the industry. This methodology looks at key economic indicators such as GDP, employment figures, and inflation, as well as central bank policies to predict how these may influence currency markets.

Traders who engage in this strategy often try to identify which currencies will do better or worse than others over a period of time. By taking into account political and economic developments, traders can develop an overall picture of how the exchange rate between two different currencies might move.

Fundamental Indicators

Fundamental indicators are those that provide insight into the general health of an economy. This includes information such as gross domestic product (GDP), inflation rates, interest rates, unemployment levels, retail sales data, and manufacturing activity reports. All of these factors can have a significant impact on currency prices as they help to determine a country’s ability to support its own money when compared to other nations.

Central Bank Policies

Central banks are responsible for setting interest rate policies for their respective countries. These policies can have a direct effect on currency markets due to their ability to influence global demand for a particular currency pair. For example, if the US Federal Reserve set higher interest rates than other central banks then investors would be more likely to purchase US dollar-based securities in order to reap higher returns on their investments. By taking into account the actions of central banks around the world, traders can get a better understanding of overall market sentiment and determine potential price movements in specific currencies.

Managed Accounts & Automated Trading

Trading forex can seem intimidating, but using a managed account or automated trading system can make it easier. Managed accounts are hands-off investments in which a dedicated trader manages your portfolio and trading activities for you. Automated trading systems, on the other hand, allow you to set parameters and rely on software programs to make trades for you.

Managed Accounts

Managed accounts provide access to professional traders who have the knowledge and experience to help you maximize your returns while minimizing your risk. These traders use a range of sophisticated strategies that take into account both short-term and long-term trends in order to achieve success.

Automated Trading Systems

Automated trading systems are computer programs that use algorithms to make decisions about when and how to trade forex. This means that you don’t need any prior experience as a trader in order to use them – all you need is a computer with an internet connection. Automated trading systems can also be used on multiple devices, so you can manage your accounts even when you’re away from the office or home.

Conclusion

In conclusion, when it comes to successfully trading forex, there is no one-size-fits-all strategy. Every trader must assess their risk appetite, style of trading, market conditions, and resources to identify a strategy that works for them.

By combining technical and fundamental analysis, traders can develop strategies that make the most of their trading capital. With the right combination of research and practice, traders can develop strategies that will help them reach their goals.

The world of forex can be overwhelming and intimidating at first, but with the right resources and strategies, you can become a successful forex trader. With time, dedication, and a willingness to learn, you can build a strategy that works for you.